In today’s digital world, where convenience and efficiency are paramount, having a reliable payment gateway integrated into a website is no longer a luxury—it’s a necessity. Whether you’re running an e-commerce store, a subscription-based service, or a donation platform, the ability to accept online payments securely and seamlessly can determine the success of your business.

What is a Payment Gateway?

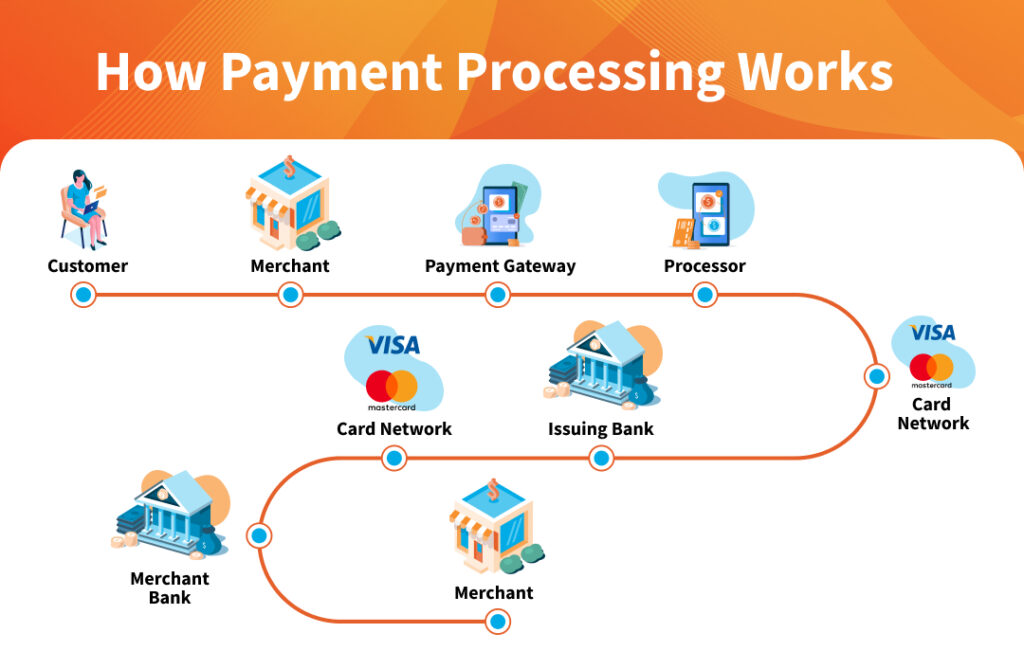

A payment gateway is the technological infrastructure that facilitates online transactions. It acts as a bridge between a customer and the merchant’s financial institution, ensuring that payments are processed securely. Think of it as the digital equivalent of a point-of-sale system in a physical store. When customers enter their payment details, the gateway encrypts this information, validates the transaction, and ensures funds are transferred from the customer’s account to the merchant’s.

Why Your Website Needs a Payment Gateway

The rise of online shopping, digital subscriptions, and virtual services has made integrated payment gateways a critical component for any business. Here’s why they matter:

1. Convenience for Customers

A smooth payment experience directly impacts customer satisfaction. With a payment gateway, users can complete transactions within seconds, without hassle. Multiple payment options, such as credit/debit cards, digital wallets, and direct bank transfers, allow customers to pay in their preferred way, making their experience seamless.

2. Security and Fraud Prevention

Cybersecurity threats are an ever-present concern in digital transactions. Payment gateways provide encryption protocols and compliance with standards such as PCI-DSS (Payment Card Industry Data Security Standard) to safeguard sensitive financial data. They also integrate fraud detection tools that help merchants minimize unauthorized transactions, charge-backs, and security breaches.

3. Global Reach and Expansion

For businesses looking to scale internationally, payment gateways allow transactions in multiple currencies and facilitate cross-border payments. With features like currency conversion and multilingual interfaces, businesses can cater to global customers without barriers.

4. Automated Payment Processing

Gone are the days of manually tracking payments. Payment gateways automate the process, ensuring real-time transaction approvals and confirmations. This efficiency helps businesses manage cash flow effectively while reducing administrative workload.

5. Subscription and Recurring Payments

For businesses offering subscription-based services—like SaaS platforms, streaming services, or membership-based models—payment gateways enable recurring payments. Customers can set up automatic billing, ensuring uninterrupted service and reducing the chances of payment lapses.

Choosing the Right Payment Gateway

With several payment gateways available in the market, selecting the right one for your website can be overwhelming. Here are key factors to consider:

1. Compatibility with Your Business Model

Not all gateways support every type of business. Some specialize in e-commerce, while others cater to digital services or donations. Choose a gateway that aligns with your industry needs.

2. Transaction Fees and Costs

Different payment providers have varying fee structures, including transaction fees, setup fees, and monthly charges. Compare costs to find a solution that fits your budget while offering top-notch security and efficiency.

3. Security Features

Look for gateways that offer advanced fraud detection, data encryption, and compliance with industry security standards. The safer your payment processing, the more trustworthy your business becomes.

4. Integration and User Experience

A payment gateway should seamlessly integrate with your website and offer a user-friendly checkout experience. Features like one-click payments, saved payment details, and mobile optimization significantly improve customer experience.

5. Customer Support and Reliability

Technical issues can disrupt transactions and impact revenue. Choose a provider with responsive customer support and a proven track record of uptime and reliability.

Popular Payment Gateways for Websites

Several payment gateways dominate the industry, offering unique features tailored to different business needs. Some of the most popular ones include:

- PayPal: Widely recognized and trusted, PayPal offers seamless transactions and supports global payments.

- Stripe: Known for its developer-friendly integration, Stripe provides highly customizable payment solutions.

- Square: Great for small businesses, Square integrates both online and offline payments effortlessly.

- Authorize.Net: A secure gateway with advanced fraud protection and subscription billing features.

- Razorpay: Ideal for businesses in India, offering diverse payment methods and automation tools.

Final Thoughts

A well-integrated payment gateway is more than just a transaction tool—it’s a gateway to business growth, customer satisfaction, and financial security. Whether you’re launching a new website or looking to optimize an existing one, ensuring that your payment system is reliable, secure, and user-friendly will enhance your credibility and drive sales.

As digital transactions continue to evolve, businesses that prioritize seamless payment experiences will remain ahead of the competition. Are you ready to power up your website with the right payment gateway?

Let’s talk—what challenges have you faced with online payments, and which gateway solution are you considering? 🚀